Introduction

What Are GMGN Tools?

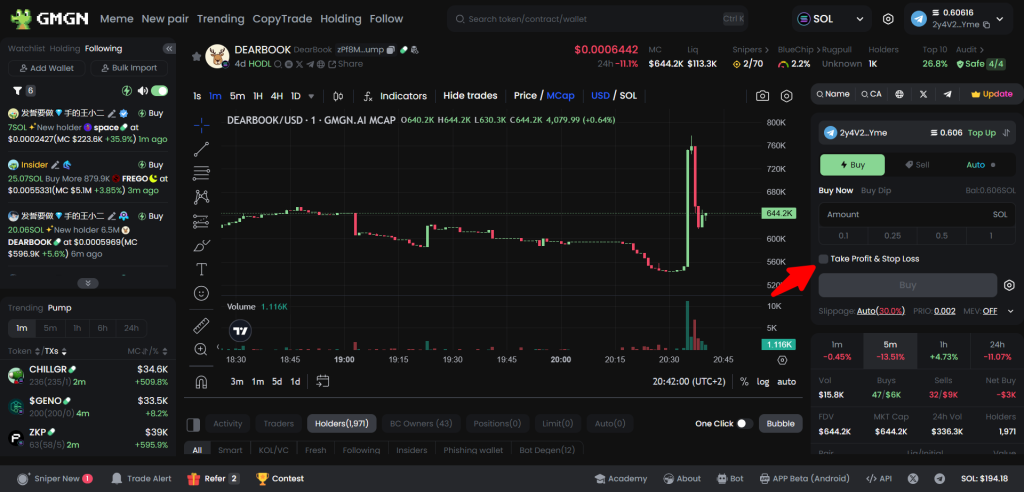

GMGN.ai is an emerging platform in the automated crypto trading ecosystem, offering tools to help traders optimize their strategies, reduce emotional decision-making, and potentially achieve remarkable returns. Utilizing AI-driven technology, GMGN tools empower traders with dynamic strategies, real-time market analysis, and robust risk management features.

These resources are designed to help beginners and seasoned veterans navigate the often chaotic crypto markets more confidently.

The Potential for 100x Gains in Crypto

Tenfold or even hundredfold gains might sound like marketing hype, but the crypto world has seen countless instances where early adopters or astute traders capitalized on market inefficiencies and rising trends. While no guarantees exist, GMGN tools aim to put traders in a better position to identify these opportunities systematically. Through data-driven decision-making, quick execution, and constant market monitoring, GMGN tools strive to bridge the gap between possibility and execution.

Balancing Expectations with Reality

Before diving in, it’s crucial to balance ambition with practicality. Achieving 10–100x gains doesn’t happen overnight, and it’s certainly not guaranteed. The path to substantial returns typically involves rigorous strategy refinement, careful risk management, and ongoing market education. GMGN tools can serve as powerful allies in this journey, but ultimately, sustained success requires a disciplined approach and continuous learning.

Understanding the Crypto Market Landscape

Why Crypto Volatility Presents Opportunities

Cryptocurrencies are inherently volatile, often experiencing dramatic price swings within hours. While this unpredictability can scare off casual investors, it also presents opportunities for substantial gains. Rapid changes in price, combined with 24/7 global market access, mean that profitable trades can occur at any time. Automated tools like GMGN are designed to respond to these shifts instantly, seizing opportunities that manual traders might miss due to time constraints or emotional hesitation.

Growth of Automated Trading

Automated crypto trading has grown exponentially as traders seek more efficient ways to manage their portfolios. In traditional financial markets, algorithmic trading has existed for decades, and now this technology is accessible to retail crypto traders. GMGN tools embrace this paradigm, offering intuitive interfaces, AI-enhanced decision-making, and customizable parameters that allow traders to shape their strategies to the market environment.

Common Barriers to Consistent Gains

Most traders find achieving consistent gains challenging due to factors like emotional bias, lack of time, and limited market insights. Manual traders may panic during price dips, fail to capitalize on sudden rallies, or miss profitable entries due to human error. GMGN aims to eliminate these barriers by providing automated, objective, and data-driven operations, thereby helping traders strive for more consistent performance.

Key Features of GMGN Tools

AI-Driven Trading Bots

The core of GMGN’s offering lies in its AI-driven bots that continuously scan the market, searching for profitable setups based on predefined rules. The AI learns from historical data, adapts to evolving conditions, and refines its decision-making over time, potentially improving the bot’s effectiveness.

Pre-Configured and Customizable Strategies

Not everyone is an expert trader, so GMGN provides pre-configured strategies to help beginners get started quickly. Meanwhile, more experienced traders can customize these strategies or build their own, tailoring entry and exit conditions, technical indicators, and risk parameters to their preferences.

Risk Management Tools and Parameters

GMGN tools emphasize robust risk management. Users can set stop-losses, take-profits, trailing stops, and maximum position sizes to prevent catastrophic losses. In volatile markets, these tools are essential for maintaining a healthy risk-to-reward ratio and striving for consistent returns.

Multi-Exchange Integration

Instead of juggling multiple exchange accounts, GMGN tools allow traders to manage everything from a single platform. This multi-exchange integration simplifies operations, provides a holistic view of the portfolio, and expands the universe of trading opportunities across various markets and liquidity pools.

Performance Monitoring and Analytics

Data is crucial for refining strategies. GMGN offers analytics and performance dashboards that help traders review their results, identify winning approaches, and spot areas for improvement. This continuous feedback loop is vital for inching closer toward those elusive 10–100x returns.

How GMGN Tools Drive Consistent Gains

Capitalizing on 24/7 Market Activity

Unlike traditional stock markets, crypto never sleeps. Manually monitoring prices around the clock is impossible, but GMGN’s bots can operate continuously. They execute trades at any hour, ensuring no opportunity goes unnoticed—whether it’s a sudden nighttime rally or a quick arbitrage window.

Emotion-Free, Data-Driven Decisions

Emotions often lead traders astray—panic selling during dips or FOMO-buying at peaks. GMGN tools operate purely on logic and data. By removing emotional bias, these tools can help maintain a consistent, long-term approach, sticking to the plan even during market turbulence.

Scalability: Running Multiple Bots and Strategies

GMGN supports running multiple bots simultaneously. Traders can diversify by deploying different strategies across various trading pairs or exchanges. This diversification reduces reliance on any single approach and may help stabilize returns, contributing to a more consistent performance over time.

Adaptive Learning and Market Analysis

Some GMGN bots incorporate adaptive algorithms that learn from market behavior. As they process large volumes of historical and real-time data, they refine their tactics. This ability to evolve with the market environment can prove invaluable in seeking consistent gains, even as conditions change.

Strategies for Achieving 100x Gains

Long-Term Trend Following

One way to aim for substantial gains is to ride long-term trends. Cryptocurrencies like Bitcoin or Ethereum have experienced exponential growth during bull runs. By using GMGN’s trend-following strategies, traders may identify when an asset enters a sustained upward trajectory. Holding positions through strong uptrends might yield those coveted multiples over months or years.

Short-Term Scalping and Market Making

For traders who prefer quick returns, scalping and market-making strategies can generate consistent, albeit smaller, profits. Over time, these incremental gains can compound significantly. GMGN bots can rapidly enter and exit positions, capturing small price discrepancies and continuously adding to your total returns.

Arbitrage Opportunities

Arbitrage involves exploiting price differences for the same asset across different exchanges. While manual arbitrage can be time-consuming and risky, GMGN bots can monitor multiple markets simultaneously, executing trades the moment they detect favorable spreads. Although each arbitrage trade might yield a small profit, the cumulative effect can be substantial, especially if repeated consistently.

Combining Fundamental Events with Bot Strategies

Crypto markets often react strongly to news, protocol upgrades, or regulatory announcements. Traders can integrate fundamental analysis into their GMGN setups by triggering bots to buy or sell based on data feeds or sentiment indicators. Capturing early moves in response to positive fundamentals has historically offered substantial upside.

Practical Steps to Get Started with GMGN

Setting Up Your GMGN Account

Begin by visiting the GMGN.ai website and creating an account. Use a secure password and, if available, enable two-factor authentication. Once verified, you’ll gain access to the dashboard, where you can configure your tools and link your exchanges.

Connecting to Your Preferred Exchanges

GMGN integrates with major crypto exchanges. By connecting your exchange accounts through API keys (with trading-only permissions, never withdrawal access), you enable the platform’s bots to place trades on your behalf. Ensure your API keys are stored securely, and follow GMGN’s guidance on best practices for account safety.

Selecting an Initial Strategy and Trading Pair

For beginners, start simple. Choose a liquid and familiar trading pair like BTC/USDT. Select a pre-configured strategy recommended for newcomers—perhaps a basic trend-following approach. By starting small and straightforward, you can learn the platform’s features without risking significant capital.

Adjusting Risk Settings: Stop-Losses and Take-Profits

Configure your stop-loss to limit potential losses if the market turns against you. Similarly, set a take-profit level to lock in gains when the price reaches your target. Adjust position sizing to ensure you’re not overexposed to any single trade. This disciplined approach helps preserve capital and paves the way for consistent returns.

Launching and Monitoring Your First Bot

After finalizing your settings, hit the “Start Bot” button. Once live, your bot begins scanning the market and executing trades according to your rules. Use GMGN’s performance dashboard to track real-time results. Observing how your bot behaves under actual market conditions is crucial for learning and refinement.

Managing Risks and Avoiding Pitfalls

The Importance of Gradual Scaling

While jumping in with a large investment is tempting, start with a small amount of capital. As you gain confidence in GMGN’s tools and observe consistent performance, consider scaling up gradually. This approach helps you mitigate large losses if your initial strategy doesn’t pan out as expected.

Diversifying Strategies and Trading Pairs

Don’t put all your eggs in one basket. Diversify by running multiple bots, each with distinct strategies and pairs. Some might focus on top-tier assets like Bitcoin and Ethereum, while others target mid-cap altcoins. If one strategy underperforms, others may compensate, smoothing out overall results.

Continuous Learning and Market Awareness

Crypto markets evolve rapidly. Stay informed about market news, regulatory developments, and emerging trends. Adjust your strategies in response to changing conditions. GMGN provides the tools, but keeping a finger on the pulse of the crypto world helps ensure you’re not caught off-guard by major shifts.

Maintaining Realistic Expectations

Aiming for 100x gains is ambitious. While traders have achieved this in the past, it usually involves catching significant market trends or unique opportunities. Keep in mind that not every strategy will yield these results. The key is consistent profit generation over time, which may eventually position you to catch those rare, exponential moves.

Advanced Tips for Maximizing Returns

Fine-Tuning Strategies with Technical Indicators

As you gain experience, consider integrating technical indicators like Moving Averages, RSI, or MACD into your GMGN strategies. These signals can help confirm entries and exits, potentially improving win rates and risk-adjusted returns. Experiment with different combinations and observe how they affect performance.

Utilizing Sentiment Analysis and Market News

Advanced traders might incorporate sentiment analysis into their strategies. For instance, if social media sentiment or news feeds turn bullish for a particular asset, your bot could increase position sizes or adjust parameters to exploit expected upward momentum. This hybrid approach combines AI-driven logic with human-led insight.

Periodic Strategy Optimization and Rebalancing

Markets change, and so should your strategies. Schedule periodic reviews—monthly or quarterly—to evaluate performance. If a strategy consistently underperforms, consider tweaking parameters or replacing it with a new approach. Continual optimization is key to long-term success.

Employing Backtesting and Simulation

GMGN may offer backtesting capabilities. Use historical data to test how your strategy would have performed during different market conditions. This lets you refine your rules before risking capital. Similarly, run simulations to experiment with various scenarios, enabling you to approach live trading with greater confidence.

How GMGN Can Help in Identifying Smart Wallets

Aggregating On-Chain and Market Data

To identify smart wallets using GMGN, you first need to feed it relevant data. This might involve:

- On-Chain Data Providers: Connect to blockchain explorers and analytics platforms (like Nansen, Glassnode, or Arkham Intelligence) that label addresses and provide wallet profiler features.

- Market Data APIs: Combine price feeds, order book data, and volume metrics from exchanges with on-chain information.

GMGN can integrate multiple data sources through custom APIs or built-in connectors, allowing you to overlay wallet activity with market trends, price movements, and trading volumes.

Using Automated Strategies to Analyze Wallet Activity

Once you have a pipeline for data, you can program GMGN bots to:

- Monitor Key Addresses: Input a list of known smart wallets identified from reputable on-chain analytics sources.

- Trigger Alerts: Set up bots to alert you when a tracked wallet makes a significant move—such as acquiring a large position in a low-cap token.

- Automated Responses: If desired, program a bot to automatically execute trades under certain conditions triggered by the wallet’s activity, such as buying a small position if the wallet invests a certain amount into a new token.

Filters, Alerts, and Notifications

With GMGN’s customization features, you can filter out noise by focusing on:

- Transaction Size Thresholds: Only trigger alerts if the wallet moves funds above a certain USD value.

- Frequency of Transactions: If a wallet has a flurry of activity in a short time, your bot can highlight this as a potential signal.

- Asset Filtering: Only track the wallet’s moves in specific categories (e.g., DeFi tokens, Layer-1 blockchains, or metaverse projects).

Strategies for Identifying Smart Wallets

Identifying smart wallets starts with good research. While GMGN can automate the response process, you need to know which wallets are worth tracking.

Volume and Frequency of Transactions

Smart wallets often manage large portfolios. Look for addresses that consistently transact in significant amounts and show profitable patterns over time. Historical data showing that a particular wallet repeatedly buys tokens before major run-ups is a strong indicator that the address might be “smart money.”

Track Record of Profitability

Leverage on-chain analytics tools to determine a wallet’s historical performance. Some platforms label wallets as “profitable traders” or track their realized gains. By identifying wallets that have outperformed the market, you can zero in on those worth monitoring with GMGN tools.

Behavioral Patterns: Buying Dips, Selling Tops

Smart wallets often buy when fear is high and prices are low, and sell or take profits before hype reaches its peak. If you find an address that repeatedly times the market well, flag it. Then use GMGN bots to send you alerts whenever this wallet makes a significant trade, indicating a potential upcoming price move.

Focus on Specific Tokens or Market Segments

Some smart wallets specialize. For instance, a known DeFi “whale” might have a knack for identifying undervalued yield farms or governance tokens. Another might be great at spotting early NFT or gaming projects. Tailor your GMGN monitoring to the niches you find most interesting so you can replicate or learn from specialists.

Building Strategies Based on Smart Wallet Activity

Once you’ve identified and started tracking smart wallets, the next step is integrating their actions into your trading strategies on GMGN.

Mirroring Trades with a Delay

The simplest strategy: When a smart wallet buys a token, your GMGN bot can respond by also buying a small position. To manage risk, you might:

- Set a Delay: Wait a few minutes or hours to see if the price stabilizes before following the trade. This avoids pump-and-dump scenarios.

- Position Sizing: Start with small allocations to test the strategy. Over time, if you see consistent returns, consider gradually increasing position size.

Contrarian Approaches: Trading Against Smart Money Moves

Sometimes, you can profit by going against the flow. For example, if a smart wallet that usually sells before market tops suddenly sells a large position, it may indicate an upcoming downturn. Your GMGN bot could respond by opening a short position or setting a tighter stop-loss on your existing longs.

Combining Smart Wallet Signals with Technical Indicators

Relying solely on smart wallet moves can be risky. Combine their signals with technical indicators available in GMGN:

- RSI or MACD Confirmation: If a smart wallet buys a token and the RSI indicates oversold conditions, this double confirmation might give you more confidence in your trade.

- Moving Averages: Use EMAs or SMAs to confirm trend direction. If smart money moves align with a bullish crossover, consider that a stronger signal.

Integrating Sentiment and Fundamental Events

Smart wallets don’t operate in a vacuum. They react to market conditions, news, and industry trends. Consider integrating sentiment data into your GMGN dashboard:

- News Feeds and Social Media Tracking: If a smart wallet accumulates a token shortly after a positive development (e.g., a major partnership or a listing on a top exchange), this may strengthen your conviction.

- On-Chain Events: Track token unlocks, protocol upgrades, or liquidity injections. If smart wallets position themselves before these events, they might anticipate positive outcomes.

Success Stories and Case Studies (Hypothetical Examples)

Long-Term Hodler Turned Automated Trader

Imagine a long-term investor who held onto major cryptocurrencies without actively trading. After integrating GMGN bots, they learn to identify when to scale into positions during dips and take partial profits during rallies. Over a few market cycles, their passive approach evolves into a more active, strategic method that significantly boosts overall returns.

Short-Term Scalper Benefiting from GMGN Bots

A short-term trader aiming for consistent small gains sets up multiple scalping bots on highly liquid pairs. Each bot captures tiny price movements multiple times a day. Over months, these incremental profits add up, turning what would be time-consuming manual tasks into a hands-off source of income.

Arbitrage Enthusiast Reducing Manual Effort

A trader previously tried arbitrage by manually monitoring prices on different exchanges—tedious and error-prone. With GMGN’s multi-exchange integration, they automate this process. The bot quickly detects price discrepancies and executes trades instantly, leading to more reliable and consistent arbitrage profits.

Frequently Asked Questions (FAQs)

Q1: Is achieving 10–100x gains guaranteed with GMGN?

No. While the platform can help identify opportunities and execute trades more efficiently, market conditions drive results. Many factors influence performance, and no tool can guarantee such returns.

Q2: Are GMGN’s strategies suitable for beginners?

Yes. GMGN provides pre-configured strategies designed for novices. Beginners can start simple and gradually learn to customize strategies as they gain experience.

Q3: How do I secure my account and API keys?

Always enable two-factor authentication and never share your API keys with anyone. Give your keys only trading privileges and disable withdrawals to reduce risk.

Q4: What exchanges does GMGN support?

GMGN supports major exchanges like Binance, Coinbase Pro, and others. Check the official documentation for a list of supported platforms and any newly added integrations.

Q5: Can I run multiple bots simultaneously?

Absolutely. Running multiple bots can help diversify strategies, reduce overall risk, and potentially stabilize returns.

Conclusion and Future Outlook

GMGN tools offer a comprehensive, AI-driven solution for crypto traders aiming to achieve exceptional returns. While 10–100x gains are not commonplace or guaranteed, the platform’s data-driven approach, continuous market monitoring, and customizable strategies can help traders optimize their performance.

Success in crypto trading often comes from consistent incremental gains, prudent risk management, and adaptability. GMGN provides the tools to streamline this process, from automated execution to performance analytics. Over time, as the crypto industry matures and AI-driven platforms evolve, traders using GMGN tools may find themselves better positioned to capitalize on emerging trends and opportunities.

The journey to substantial gains involves patience, learning, and persistence. By leveraging GMGN’s technology, traders can navigate complex markets more confidently, potentially stacking profits that one day lead to extraordinary results. Keep refining strategies, stay informed, and remember that the key to long-term success in crypto trading is not a single lucky trade but a disciplined and well-executed plan carried out over many market cycles.

Disclaimer: The content in this article is for informational purposes only and should not be taken as financial advice. Cryptocurrency trading carries inherent risks, and individuals should conduct thorough research and consider their personal risk tolerance before engaging in any trading activity.