Introduction to Automated Crypto Trading

What Is Automated Trading?

Automated trading refers to using software—“trading bots”—to place and manage trades according to predefined rules. Instead of sitting in front of your computer screen and monitoring charts 24/7, you let an algorithm do the heavy lifting.

Automated trading systems can continuously scan the market, identify trends, and execute trades based on your configured criteria. This streamlines the trading process, reducing the time and emotional stress associated with manual trading.

Automated trading has its roots in traditional financial markets, where institutional traders have used algorithms for decades. Today, these capabilities have trickled down to retail traders, especially in the cryptocurrency space, where volatility, high trading volumes, and a 24/7 market environment present both incredible opportunities and enormous challenges.

Why Use a Crypto Trading Bot?

The crypto market never sleeps. It’s active every hour of every day, which can be exciting and exhausting. As a human, you need sleep, breaks, and time away from your computer. A trading bot does not. By deploying a trading bot, you ensure your strategies are executed consistently—even when you’re not watching.

Some key benefits include:

- Emotion-Free Trading: Bots don’t experience fear, greed, or excitement. They follow logic and rules, which can help maintain a disciplined approach.

- Speed and Efficiency: Automated bots can react to market changes in milliseconds, potentially capturing trading opportunities that manual traders might miss.

- Backtesting and Consistency: Most bots or platforms allow you to test strategies with historical data. Once a plan is set, it will execute the same way every time, ensuring consistency.

The Rise of AI-Driven Trading Platforms

In recent years, machine learning and artificial intelligence advancements have led to more sophisticated trading algorithms. AI-driven platforms like GMGN.AI leverage pattern recognition, sentiment analysis, and complex data analytics to refine trading strategies. This doesn’t guarantee profit, but it does offer more data-driven insights and a level of sophistication that older, rule-based bots might lack.

Overview of GMGN.AI

What Is GMGN.AI?

GMGN.AI is a cutting-edge automated crypto trading platform. It differentiates itself by integrating AI-driven insights into user-friendly tools. Whether you’re a beginner who wants a “set-and-forget” strategy or an experienced trader looking to fine-tune your approach, GMGN.AI aims to accommodate all skill levels.

Key Features and Competitive Advantages

- User-Friendly Interface: Even if you’re new to crypto, the dashboard and tools are intuitive. The platform guides you step-by-step, from creating an account to launching your first bot.

- Pre-Configured Strategies: Not sure where to start? GMGN.AI offers preset strategies tuned for different market conditions. Beginners can pick a recommended strategy without feeling overwhelmed.

- Customizability: Advanced users can tweak parameters, integrate additional indicators, or set complex risk management rules.

- Multi-Exchange Support: Manage your trades across multiple exchanges from a single platform. This centralization saves time and streamlines portfolio management.

- 24/7 Monitoring: The bot never rests. It continuously scans markets, seeking opportunities aligned with your chosen strategy.

Safety and Security Measures

Security is paramount in crypto. GMGN.AI uses encrypted communication and secure storage for your API keys. It does not require withdrawal permissions on your API keys, meaning the bot can trade on your behalf but cannot move funds out of your exchange account. This significantly reduces the risk of unauthorized withdrawals.

Additionally, GMGN.AI encourages users to enable two-factor authentication (2FA) to further secure their accounts. Always remember: While the platform’s internal security is strong, maintaining best security practices on your end is equally critical.

Getting Started: Creating Your GMGN.AI Account

Signing Up for GMGN.AI

The first step is straightforward:

- Visit the Website: Navigate to https://gmgn.ai/.

- Find the Sign-Up Button: Usually located at the top-right corner of the homepage, click on “Sign Up.”

- Enter Your Details: Input your email address and a secure password. Make sure this password is unique and not used elsewhere, as account security is critical.

- Submit: Click “Create Account.”

Within seconds, you’ll receive an email confirming your registration.

Verifying Your Email and Logging In

Before you can fully use the platform, you must verify your email address:

- Check Your Inbox: Open the verification email from GMGN.AI.

- Click the Verification Link: This confirms your email and activates your account.

- Return to GMGN.AI: Log in with the credentials you just created.

Navigating the Dashboard: A First Look

Once logged in, you’ll land on the GMGN.AI dashboard. Here’s what you can typically expect:

- Top Navigation Bar: Quick access to account settings, help resources, and support.

- Left Sidebar Menu: Where you’ll find key sections like “Portfolio,” “Bots,” “Settings,” and possibly a “Marketplace” or “Strategy” section depending on updates to the platform.

- Main Panel: Displays a summary of your portfolio, recent trades, and performance metrics. Initially, if you haven’t connected an exchange or started a bot, this area may look empty or show tutorial hints.

Spend a few minutes clicking around to understand what each section offers. Familiarizing yourself with the interface now will pay off later when you start configuring bots.

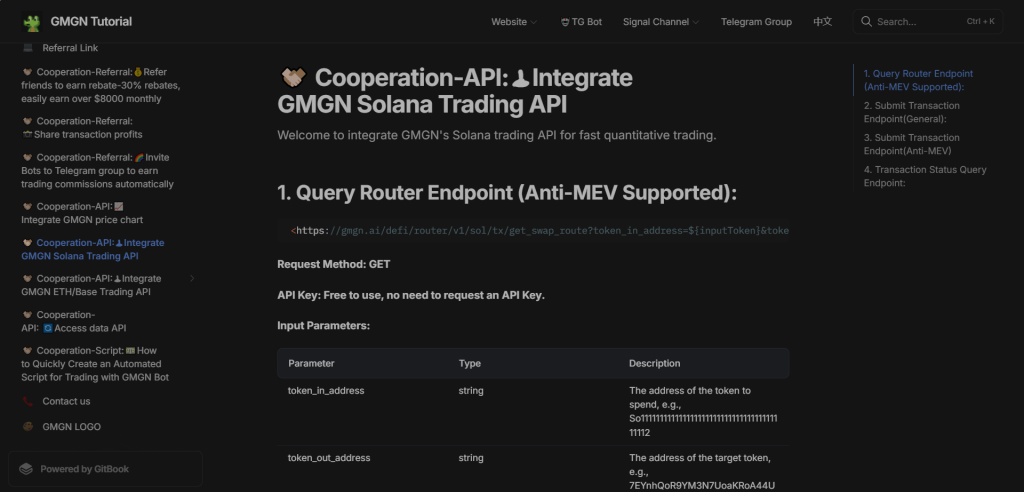

Connecting Your Exchange Account

Understanding Exchange Integration

GMGN.AI acts as a layer on top of your preferred crypto exchange. It doesn’t store your funds; instead, it executes trades via the API keys you provide. This integration allows you to manage all your trading from one central platform.

Setting Up API Keys Securely

To connect your exchange (e.g., Binance, Coinbase Pro, or Kraken), you’ll need API credentials:

- Go to ‘Settings’ → ‘API Keys’: In GMGN.AI’s dashboard, look for a tab called “Settings” or “API Keys.”

- Click ‘Connect Exchange’: A drop-down menu will show supported exchanges.

- Generate API Keys on Your Exchange: Log in to your chosen exchange and navigate to its API management page. Generate a new API key and secret.

- Important: The API key should have trading permissions only. Disable withdrawal permissions to enhance security.

- Input API Keys into GMGN.AI: Paste the API key and secret into the fields provided. Click “Save.”

Supported Exchanges and Compatibility

GMGN.AI supports major exchanges known for their liquidity and reliability. The list may expand over time, but common options include:

- Binance: A leading global exchange with a wide variety of trading pairs.

- Coinbase Pro: Popular for U.S. traders, known for regulatory compliance.

- Kraken: Offers robust security and a wide selection of coins.

Before deciding on an exchange, consider factors like liquidity, fees, available trading pairs, and regional availability.

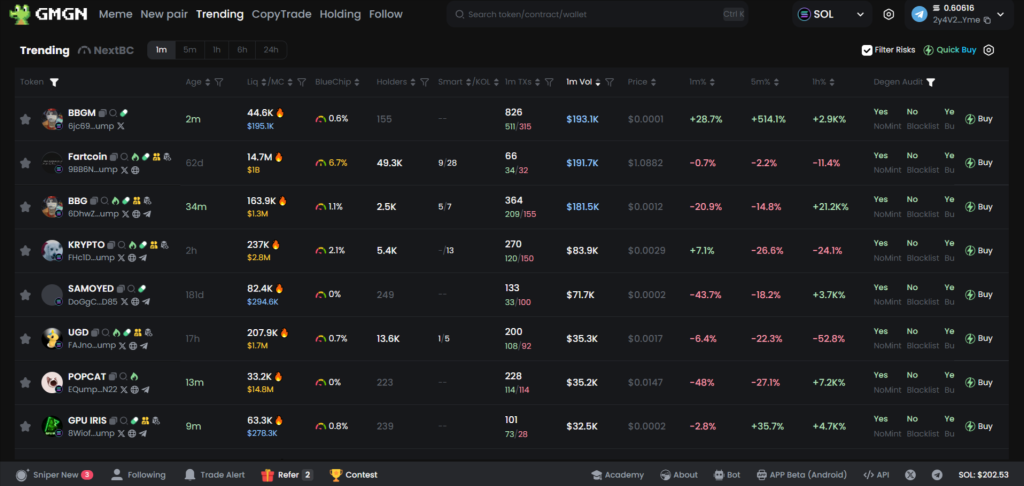

Exploring the GMGN.AI Dashboard and Features

Dashboard Layout and Navigation

The dashboard is your command center. On the left-hand side, you’ll find navigation links to different sections. Typically:

- Portfolio: View current holdings, balances, and historical performance.

- Bots: Create, manage, and monitor your automated trading strategies.

- Settings: Adjust account preferences, manage API keys, and enable security features like 2FA.

Key Metrics: Portfolio Balance, Profit/Loss, and Recent Trades

In the main panel, you might see:

- Portfolio Balance: A summary of the total value of your holdings across connected exchanges, often displayed in BTC, USD, or other stable currencies.

- Profit/Loss (P/L): Track how much you’ve gained or lost over various time frames (24 hours, 7 days, 30 days).

- Recent Trades: A quick overview of the last trades executed by your bot(s), including price, quantity, and timestamp.

These at-a-glance metrics help you gauge your overall performance and make quick assessments about your strategies.

The Bots Section: Your Control Center

The “Bots” section is where the real action happens. Here, you can:

- View Existing Bots: See all the bots you’ve created, their status (running, paused, stopped), and key metrics like P/L.

- Create New Bots: Start the process of setting up a fresh strategy.

- Edit and Delete Bots: Adjust parameters as markets change or stop a bot if you need to reassess.

Creating Your First Trading Bot

Selecting a Trading Strategy

The strategy you choose determines how your bot behaves. GMGN.AI often provides a range of preset strategies:

- Trend-Following: Buys assets that are showing upward momentum, selling as soon as the trend weakens.

- Market-Making: Places both buy and sell orders around the current price to capture small profits on the bid-ask spread.

- Mean Reversion: Assumes prices will revert to a mean over time, so it buys dips and sells when prices recover.

- Arbitrage (if supported): Attempts to profit from price differences across multiple trading pairs or exchanges.

Beginners may start with a recommended “Basic” or “Trend-Following” strategy. Over time, you can experiment with more complex approaches.

Choosing Trading Pairs

A trading pair is the two assets you’ll be trading (e.g., BTC/USDT or ETH/BTC). Selecting the right pair is crucial:

- Liquidity: High-volume pairs like BTC/USDT ensure smooth execution and tighter spreads.

- Volatility: More volatile pairs offer larger profit opportunities but come with higher risk.

- Familiarity: Start with pairs you understand. If you’re familiar with Bitcoin and stablecoins, begin there before experimenting with altcoins.

GMGN.AI usually provides a drop-down menu of available pairs on your connected exchange when creating a bot. Pick one that aligns with your trading strategy and risk appetite.

Risk Management Settings: Stop-Losses, Take-Profits, and Position Sizing

Risk management is one of the most critical elements of successful trading. GMGN.AI typically allows you to set:

- Stop-loss: Automatically close a position if the price moves against you by a certain percentage. This protects capital in catastrophic moves.

- Take-Profit: Lock in gains once the price reaches a predefined profit target.

- Position Sizing: Determine how much capital to allocate per trade. Starting small helps limit losses while you learn.

For beginners, consider conservative settings. For instance, a small position size and a modest stop-loss can help you get comfortable without risking large amounts of capital.

Starting, Monitoring, and Adjusting Your Bot

Launching Your First Live Bot

After configuring your bot, you’ll reach a review screen. Double-check all parameters, including the strategy type, trading pairs, and risk management settings. If everything looks correct:

- Click “Start Bot”: This activates the bot and begins live trading based on your chosen strategy.

- Confirmation: A message or notification should confirm the bot is now live.

Interpreting Performance Metrics and Charts

Now, the real fun begins. Your bot will start placing trades according to your rules. In the bots dashboard, you can monitor:

- Profit/Loss: See if you’re in the green or red.

- Trade History: Every executed trade is logged with time, price, and size.

- Performance Charts: Visual graphs showing how your bot’s equity curve changes over time.

Analyzing these metrics helps you understand how well your bot is performing. If the bot is making consistent profits, great! If not, you may need to adjust parameters or switch strategies.

Pausing, Stopping, and Editing Bots

Markets change, and so should your strategies when necessary. GMGN.AI allows you to:

- Pause: Temporarily halt trading activity without deleting the bot. This is useful if you want to observe the market without taking new positions.

- Stop: Shut down the bot entirely. Positions may be closed or remain open depending on your settings—check the platform’s instructions for details.

- Edit Bot Settings: Tweak strategies, risk parameters, or trading pairs. After editing, you can relaunch the bot to implement your new rules immediately.

Flexibility is key. Don’t hesitate to make changes if your initial configuration isn’t delivering the desired results.

Advanced Features and Strategies

Customizing Strategies and Technical Indicators

Once you’re comfortable with basic strategies, consider customizing indicators or adding more complexity to your approach:

- Technical Indicators: Add tools like Moving Averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence) to refine entry and exit conditions.

- Multi-Layered Approaches: Combine trend-following with mean reversion signals to diversify how your bot reacts to varying market conditions.

- Time-Based Rules: Trade only during high-volume market hours or pause during low liquidity periods.

Check if GMGN.AI provides a strategy builder or advanced custom settings that let you incorporate these elements.

Diversifying Bots and Trading Pairs

Rather than relying on a single bot and pair, consider multiple bots:

- Different Strategies: Run one bot on a trend-following strategy with BTC/USDT and another on a mean reversion strategy with ETH/USDT.

- Risk Spreading: If one strategy underperforms due to market conditions, another might do better. Spreading risk can stabilize overall returns.

Think of your bots as a small trading team, each with a different role.

Integrating News and Market Sentiment Analysis

AI-driven platforms sometimes incorporate sentiment analysis. While GMGN.AI primarily focuses on technical metrics, you can combine external tools to inform your strategies. For instance:

- News Feeds and Alerts: Keep an eye on market-moving headlines. A major regulatory announcement or technological breakthrough can shift market sentiment suddenly.

- Social Media Sentiment: Crypto Twitter, Reddit, and other forums heavily influence short-term market moves. You can manually adjust your bots’ risk parameters if you anticipate unusual volatility.

While fully automated sentiment analysis might not be integrated directly, informed traders can use external data to refine their approach.

Best Practices for Beginners

Starting Small and Scaling Up

When you start using a trading bot, keep your capital allocation small. This minimal exposure allows you to learn the platform, understand the strategy’s behavior, and gain confidence without risking significant capital. You can gradually scale up as you gain experience and see consistent results.

Consistent Monitoring and Periodic Reviews

Automated doesn’t mean hands-off forever. Periodically review your bot’s performance:

- Weekly Check-Ins: At least once a week, evaluate how the bot is doing. Are you meeting your profit targets? Is the market changing in ways that require adjustments?

- Monthly Strategy Overhauls: Every month or quarter, consider reviewing all bots and possibly adding new strategies or pruning ineffective ones.

By staying engaged, you ensure your bot remains aligned with your goals and market conditions.

Keeping Up with Market Conditions

Crypto markets are notoriously volatile. A strategy that works well in a bullish environment may falter when the market turns sideways or bearish. Stay informed:

- Market Analysis: Keep track of market sentiment, upcoming events (like Ethereum upgrades or Bitcoin halvings), and regulatory changes.

- Adjust Accordingly: Be ready to pivot. Sometimes, that means lowering your position sizes, changing pairs, or switching strategies entirely.

The most successful traders adapt to changing environments.

Troubleshooting and Frequently Asked Questions

Common Issues and Their Solutions

- Bot Not Starting: Double-check your API keys and ensure your exchange account is fully verified. Also, confirm that you’ve selected a valid trading pair that is supported on your exchange.

- No Trades Executed: The bot may be waiting for a signal that meets your strategy’s criteria. Consider loosening constraints or choosing a more active trading pair.

- Unexpected Losses: Even the best strategies incur losses. Ensure your risk management rules are appropriately set. If losses exceed your comfort level, pause the bot and reassess.

FAQs on Security, Fees, and Limits

Q: How secure is GMGN.AI?

A: GMGN.AI uses encrypted communication and does not require withdrawal access to your exchange. This structure greatly reduces the risk of losing funds to unauthorized parties. Always enable 2FA for extra protection.

Q: Does GMGN.AI charge fees?

A: GMGN.AI may have a subscription fee or a commission-based model. Check the official website for the latest fee structure. Exchange trading fees still apply, as your exchange charges those, not GMGN.AI.

Q: Are there trading limits?

A: Limits often depend on your exchange’s API permissions, the trading pair’s liquidity, and your chosen strategy. GMGN.AI itself may not impose strict trading limits, but details must always be verified on their official documentation.

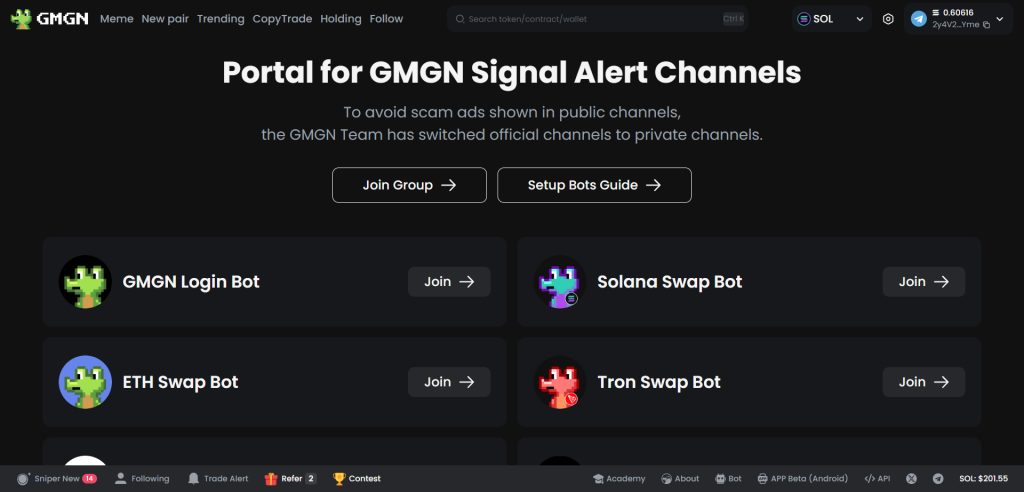

Where to Find Additional Support

If you encounter issues beyond the scope of this article:

- Help Center: GMGN.AI likely provides a knowledge base or FAQ section on their website.

- Community Forums or Discord: Engage with other users to learn best practices and troubleshooting tips.

- Customer Support: If you need personalized help, reach out to GMGN.AI’s support team, which is often accessible through a contact form, email, or live chat feature on their site.

Conclusion and Future Outlook

As the cryptocurrency ecosystem evolves, tools like GMGN.AI represent a step towards more accessible and intelligent trading solutions. These platforms can help new and seasoned traders navigate the complex and often volatile crypto markets by automating strategies, leveraging AI insights, and offering user-friendly interfaces.

Starting with a simple trend-following strategy on a major pair like BTC/USDT and gradually moving towards more advanced setups is an excellent way to become comfortable with automated trading. Over time, you might diversify into multiple bots, integrate more sophisticated indicators, or develop custom strategies.

Always remember that no trading bot can guarantee profits. Markets are unpredictable, and risk management is your best friend. Use this guide as a foundational resource, but continue to learn, adapt, and experiment as you gain experience.

The future of crypto trading likely lies in the synergy between human intuition and AI-driven automation. As platforms like GMGN.AI refine their offerings, traders will have more opportunities to optimize their approaches, minimize emotional errors, and potentially achieve more consistent results over the long term.

Final Thought: While this article provides a comprehensive guide, it’s essential to stay informed about updates, new features, and changes in best practices. Visit https://gmgn.ai/ regularly, follow community forums, and never stop learning. Crypto markets evolve quickly, and so should your strategies. Good luck and happy trading!